6 minutes

29/06/2020

Vulnerable clients and the impact of Covid-19 on estate planning

With the view to finalising ‘Guidance for firms on the fair treatment of vulnerable customers later this year, the FCA has stated clearly what they would like to achieve.

With the view to finalising ‘Guidance for firms on the fair treatment of vulnerable customers later this year, the FCA has stated clearly what they would like to achieve:

‘Our aim is to change the discourse from whether the right boxes have been ticked to achieve compliance, to firms stepping back to ask what their vulnerable customers' needs are, and how they are responding to then deliver good outcomes - and to embed this thinking in their culture, practices and processes throughout the whole consumer journey, from product design to customer service.’ Nisha Arora, Director, Consumer and Retail Policy, FCA

Vulnerabilities come in all shapes and sizes, they can be permanent or transient, and appear at any point in a person’s lifetime. This presents several challenges for financial advisers who often only see clients once or twice a year. We have summarised the following approaches to help you.

Identifying a vulnerable client

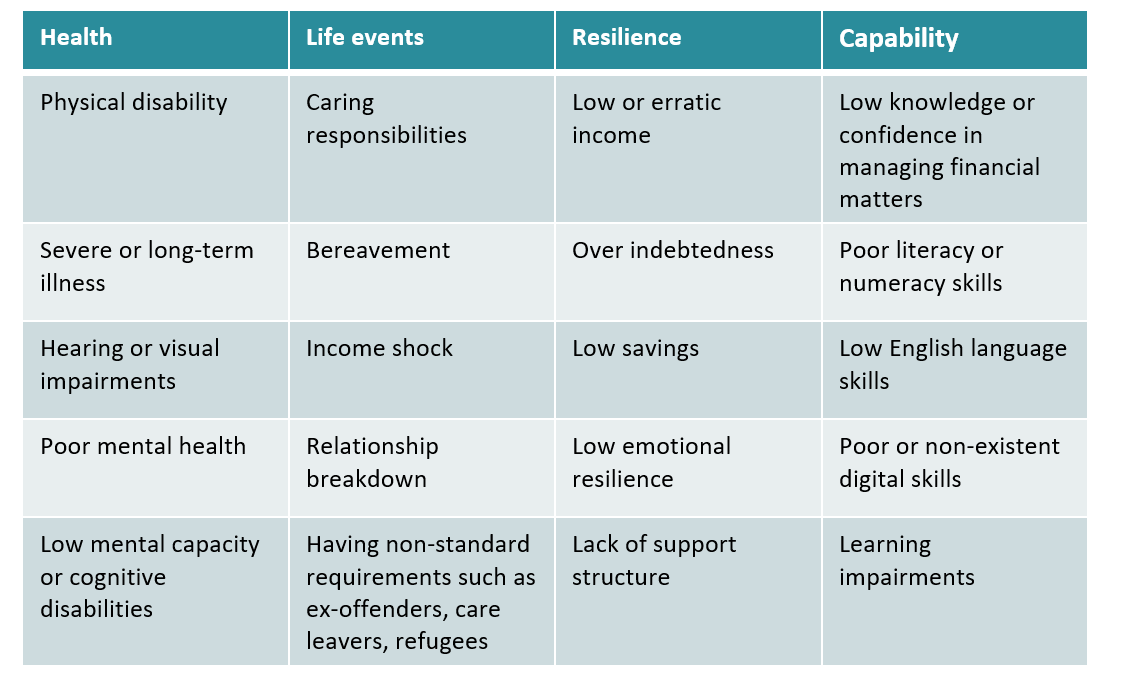

Half of UK adults display one or more characteristics of being potentially vulnerable (Financial Lives Survey 2017). To help indicate potential vulnerability, the ‘four key drivers of vulnerability’ table is good to reference:

Source: Guidance for firms on the fair treatment of vulnerable customers

It’s also worth remembering some demographics are more likely to be vulnerable than others, and these include those under 24, over 65, the unemployed, and those with no formal qualifications.

Training and development

Building the skills and capability of your team is essential to deal with vulnerable clients effectively. One approach is to use external resources to inform team members about vulnerability. Developing your products, services and communication materials to meet the needs of vulnerable clients is also important. Embedding appropriate processes in every aspect of your work, including monitoring and evaluation, will help identify areas of improvement. Making these improvements will allow you to deliver the good outcomes the FCA are wanting you to achieve.

Discussing vulnerability with a client

It’s a difficult subject to approach, the TEXAS questioning framework, used by psychologists and counsellors, is designed to manage initial conversations about a client’s vulnerable situation. This method can help gather the information advisers need to support, and explain coherently, at a time when the client needs it most, how the information will be used and what the next steps will be:

Thank the client for telling you.

Explain how the information they have provided will be used, why it’s being collected, who it will be shared with and how it will help inform decisions.

Ask for eXplicit consent to use the information in this way.

Ask other appropriate questions for example, do you need help with your finances from a carer or relative? Does your mental health affect your ability to communicate with us?

Signpost to sources of help and support.

The impact of Covid-19 on estate planning

At Foresight, one of the main groups of vulnerable clients we deal with are those over 70. Because life insurance is one of several tools used in estate planning, we recently conducted research of the UK life insurance market. Our findings indicated that Covid-19 is having a profound impact on the ability of elderly people to access cover and we wanted to share this with you.

Before accepting any person on risk, life insurers will consider an individual’s medical records. For older clients, full medical underwriting is much more prevalent and will involve, at a minimum, a medical examination by a nurse, or, a more comprehensive examination by a doctor.

The availability of nurses and doctors to perform the necessary medical examinations has been severely limited during Covid-19. This is due to the strains that the pandemic is placing on the UK health sector. Foresight research of the UK life insurance market suggests that cases that require medical underwriting are being postponed by between three and six months depending on insurer. Additionally, delays are expected in the completion of the General Practitioners Report (a piece of evidence that insurers can request that is separate to a nurse or doctor’s examination), due to the extra pressure placed on GP surgeries by the crisis.

The postponement of life insurance cases is leaving individuals exposed during the application process. When cases are postponed the applicant no longer benefits from temporary cover that is often afforded during the underwriting process.

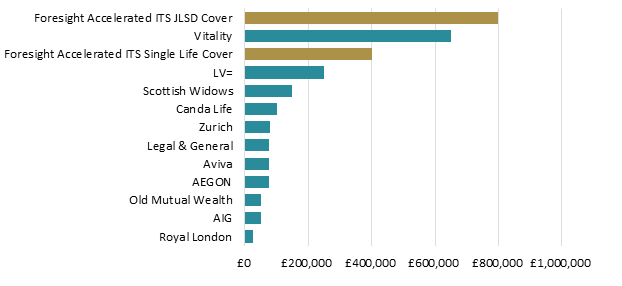

Foresight analysis of the underwriting limits guidelines of eleven UK life insurers indicates that the maximum sum insured that a person aged 76+ can access without medical examination is £144,000 on average. However, these are guidelines only; applying for cover for amounts beneath these limits does not preclude the insurer from requesting a medical examination as part of the underwriting process if it so chooses.

Foresight analysis of a sample of life insurers indicates that insurers are changing their application process in response to Covid-19. Six of the seven insurers reviewed have changed their application forms to include Covid-19 questions, with one now taking into consideration how travel and employment may have exposed individuals to the pandemic. Where a risk of Covid-19 is flagged, either further questions are asked of the applicant or the underwriting decision is postponed by a month.

This year we upgraded the Foresight Accelerated Inheritance Tax Solution (Accelerated ITS) which immediately improves investors’ chances of successful Inheritance Tax (IHT) mitigation by uniquely combining the benefits of Business Relief (BR) and life insurance. To access Foresight Accelerated ITS no medical underwriting is required, investors simply must sign and date a terminal illness declaration that they are not suffering from a terminal illness.

Maximum Sum Insured Available Without Medical Underwriting for Individuals Aged 76+

GBP

Notes: ‘JLSD’ stands for Joint Life Second Death

The level of protection available under Foresight Accelerated ITS is £400,000 for Single Life Cover (equivalent to a £1 million investment) and £800,000 for Joint Life Second Death Cover (equivalent to a £2 million investment). The product’s maximum sum insured compares favourably when benchmarked against what individuals can access without medical underwriting in the rest of the UK life insurance market. To help you determine the potential return of an investor in the Foresight Accelerated ITS, click here to use our illustration tool. For further information, contact us on +44(0)20 3667 8199 or sales@foresightgroup.eu.

Disclaimer:

The value of an investment can fall as well as rise. Investments in smaller unquoted companies are higher risk than investments in larger quoted companies. Investors may not get back the full amount they invest.

Past performance is not a reliable indicator of future results.

We recommend investors seek professional advice before deciding to invest. Foresight is not able to offer investment advice.

There can be no guarantee that the underlying investments will continue to qualify for Business Relief (“BR”). A failure to meet the BR qualifying requirements could result in the investments losing their inheritance tax exempt status, resulting in adverse tax consequences for investors.