Private Equity

1 minute

27/07/2021

Exploring the convergence of Private Equity and VC

Once two distinct financial markets, the lines between PE and VC are becoming ever-more blurred. PE firms are increasingly investing in early stage companies, and more VCs are adopting PE-style strategies with increased investment timeframes. But what are the implications of this convergence?

Once two distinct financial markets, the lines between PE and VC are becoming ever-more blurred. PE firms are increasingly investing in early stage companies, and more VCs are adopting PE-style strategies with increased investment timeframes. But what are the implications of this convergence?

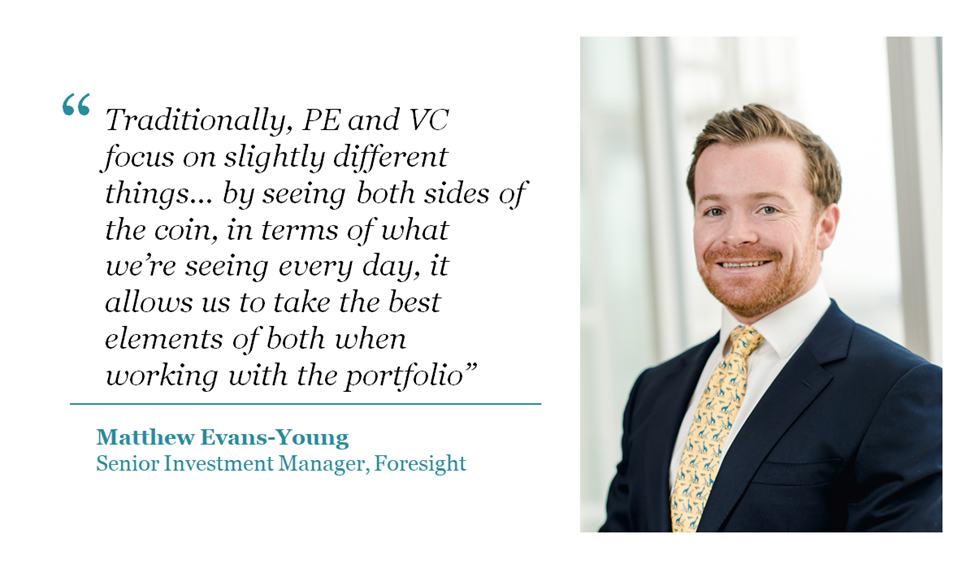

Matt Evans-Young, senior investment manager in Foresight’s private equity team, joined Claire Cherry, principal at True, to explore this market phenomenon and its implications in an episode of the Real Deals: On Air podcast.

Click here to listen.

The opinions of speakers are not necessarily those of the Company.